Recycling Technology Assets

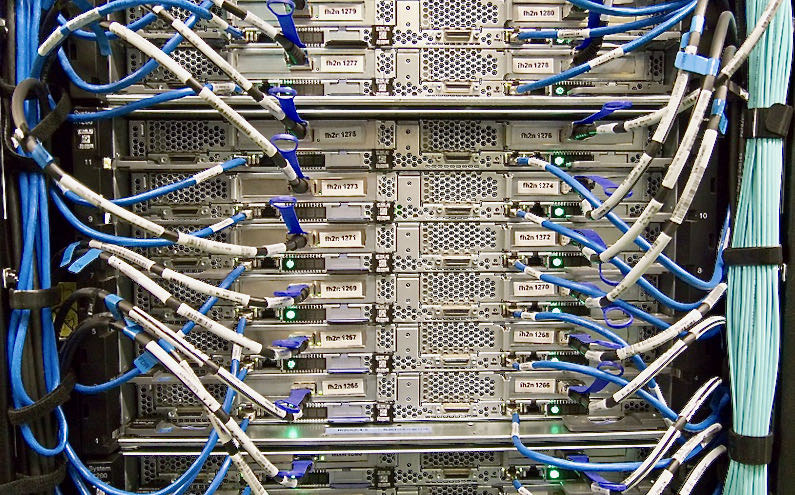

Major companies with large IT departments or data centers regularly have to dispose of broken or obsolete electronics. The modern world of privacy laws and environmental concerns makes the issue complicated and the accelerating rate of technology change exacerbates the problem

To resolve the issue, most companies now rely on third-party vendors who specialize in recycling technology assets. These electronic recyclers break down end-of-life products to recycle almost every part of them from circuit boards to steel, plastic and glass.

A Look at the Market

A March 1, 2022 report from Global Industry Analysts reported:

“Electronics recycling is set to experience increasing attention across countries as a result of rising electronic waste or e-waste. The future of electronics recycling is anticipated be significantly influenced by ongoing changes such as technological advancements and consumer inclination towards advanced products that is shortening the replacement cycle and generating significant volumes of electronic waste. The recycling technology depends heavily on a number of aspects like manufacturing approaches, purchasing behavior and use of electronics. The e-waste recycling industry is anticipated to gain from rising environmental concerns and the need to recover precious metals from e-waste. Other key factors driving the market include favorable government guidelines and regulations for managing e-waste and recycling programs globally; increasing disposable income and purchasing power of people leading to increased spending on varied electronic consumer products; and increasing affordability of consumer electronic devices. The increasing adoption of electronics recycling to refurbish functional components and high-value materials that can be reused in products is expected to drive the market growth.”

Source: Global Industry Analysts Inc.

Estimates for 2022 are the global market for electronics recycling will reach $39.7 billion. The projection is it will hit $65.8 billion by 2026.

The U.S., which makes up 21.72 percent of the global technology recycling market, is expected to generate $8 billion in 2022. Other countries with billions in recycling revenue projected over the next few years are China, Japan, Canada, and Europe.

Global vs the U.S.

Smaller companies with offices only in the U.S. are keeping technology disposal tasks in-house with many implementing choices based on technology and protocols from decades ago. Those choices include:

- Clean and scrub all data and reset them to factory standards for reuse elsewhere in the company.

- Donate scrubbed technology to schools for students to learn basic skills.

- Donate scrubbed computers to non-profit groups to help at-risk populations.

- Attempt to dismantle and resell technology parts to mills and recycling companies.

For eco-friendly organizations, such as Seventh Generation, these methods work well. It retires all of its equipment in-house and doesn’t plan to outsource the recycling. But Seventh Generation only has 100 employees so its technology assets are limited.

States like Indiana are going all-in on technology recycling. The Indiana Office of Technology (IOT) takes donated assets from its 26,000 users to the state’s school systems. It gets a second life in classrooms where students only need basic programs to learn computer skills.

Indiana created the IOT to deal with ever-changing technology that also includes upgrades and recycling. The office saved nearly $14 million in its first two years by focusing on server virtualization, data center consolidation, and energy-efficient desktops.Energy-efficient desktops were part of a major upgrade that also saved approximately $400,000 in electrical costs. The upgrade then included the recycling effort in state schools.

Two issues remain a priority whenever a company looks at such a recycling vendor, these include protecting data on the equipment and making sure the method of disposal safeguards the environment.

Protecting Data

Companies, like Marriott International Inc., said they take on the data protection responsibility themselves instead of trusting a vendor. Marriott makes sure its assets are scrubbed no matter where they go.

It uses products that meet the same standards for data cleansing as the U.S. Department of Defense and does seven wipes when the DOD sets its standards at three. A technology recycling company that has best-in-class protocols to destroy sensitive data has a distinct market advantage.

Protecting Environment

Large, international companies are increasingly conscious about proper recycling that conforms to local laws, regardless of where it occurs in the world. A company like Marriott uses recycling technology companies that have a global presence so they can remain up-to-date with local laws.

There are fewer conflicting laws among states and local governments in the U.S. but it remains something companies are struggling to monitor. After all, they don’t want their image tarnished should it be discovered that technology meant for recycling is being dumped somewhere, and this has happened more than once.

Companies that recycle electronics correctly take the old device apart and sell the parts separately. Steel is sold to a mill and plastic is sent to processors who use it for pellets. Copper is sold to metal mills.

Those who recycle technology said that only 1 to 2 percent of the original asset’s weight is left over after the equipment is stripped down and sold. That residue goes into a hazardous waste landfill.

More technology recycling companies are pushing into the market and that has prompted some to cut corners.

Basel Action Network, a group that highlights e-waste globally, claims as much as 80 percent of technology meant for recycling is found on barges going to India, Nigeria, China, Vietnam, and Ghana where it sits in landfills. Those countries don’t legislate against electronics being dumped in landfills.

Some illicit recycling businesses pay others in those countries cheaply to dispose of it instead of recycling it.

Basel Action Network also offers an e-Stewards program to identify technology recycling providers that operate to best practice in recycling and reusing technology assets, although many companies not in that program meet equally demanding standards.

More Monitoring

Companies now are forced to do more than monitor where their technology goes. It is recommended protocol to ask outsource vendors to submit proof that technology is being disposed of in a manner that is both legal and environmentally responsible.

One way to do that is to gain certification. Responsible recyclers provide certifications for data destruction, attesting to the fact that the business is meeting best-in-class standards.

Other companies, like Citigroup Inc., have a tracking program in place with their outsource recycling vendor. It tells them where every component ends up.

Choosing a Technology Recycler

A company seeking to outsource technology recycling needs protocols in place to validate the recycler’s methods along with a trackable, monitoring plan, according to those who have been through the process.

Having plans before choosing a vendor will provide confidence that proper procedures are followed. It also allows a company to avoid the need to micro-manage assets globally as they all become trackable with new smart technology.

Recycling technology assets with Potomac eCycle will give you peace of mind, knowing that the problem will be taken care of professionally and safely. Contact us today to find out what we can do for your business.

Recent Comments